Unlock liquidity without selling your crypto or NFTs. Borrow Stablecoins or crypto on Rain.fi while keeping your holdings. Flexible terms and instant funds with Peer-to-Peer System.

RainFi Team

Looking for liquidity without selling your crypto assets? With Rain.fi’s Borrow function, you can borrow Stablecoins or other tokens using your SOL, wETH, wBTC, or NFTs as collateral.

Unlike traditional lending platforms, Rain.fi allows you to set flexible loan conditions and borrow directly from user-created liquidity pools. Borrowed assets are sent directly to your wallet, while your deposit (collateral) remains locked on Rain.fi for the loan duration.

✅ How borrowing works on Rain.fi

✅ Why borrowing is better than selling your assets

✅ Use cases for borrowed funds

✅ Key strategies for managing your loan effectively

The Borrow function on Rain.fi allows users to access liquidity by depositing crypto assets or NFTs as collateral. Borrowers can take out loans in Stablecoins or any other tokens supported by Rain.fi without selling their holdings.

📌 Key Benefit: You can use borrowed funds however you like, whether for trading, yield farming, staking, or other DeFi strategies.

📌 If the deposit asset increases in value, it remains locked on Rain.fi until the loan is repaid or extended. This is where it becomes interesting — if the deposit asset appreciates, you can retrieve it at its higher value once the loan is settled, allowing you to benefit from its price increase.

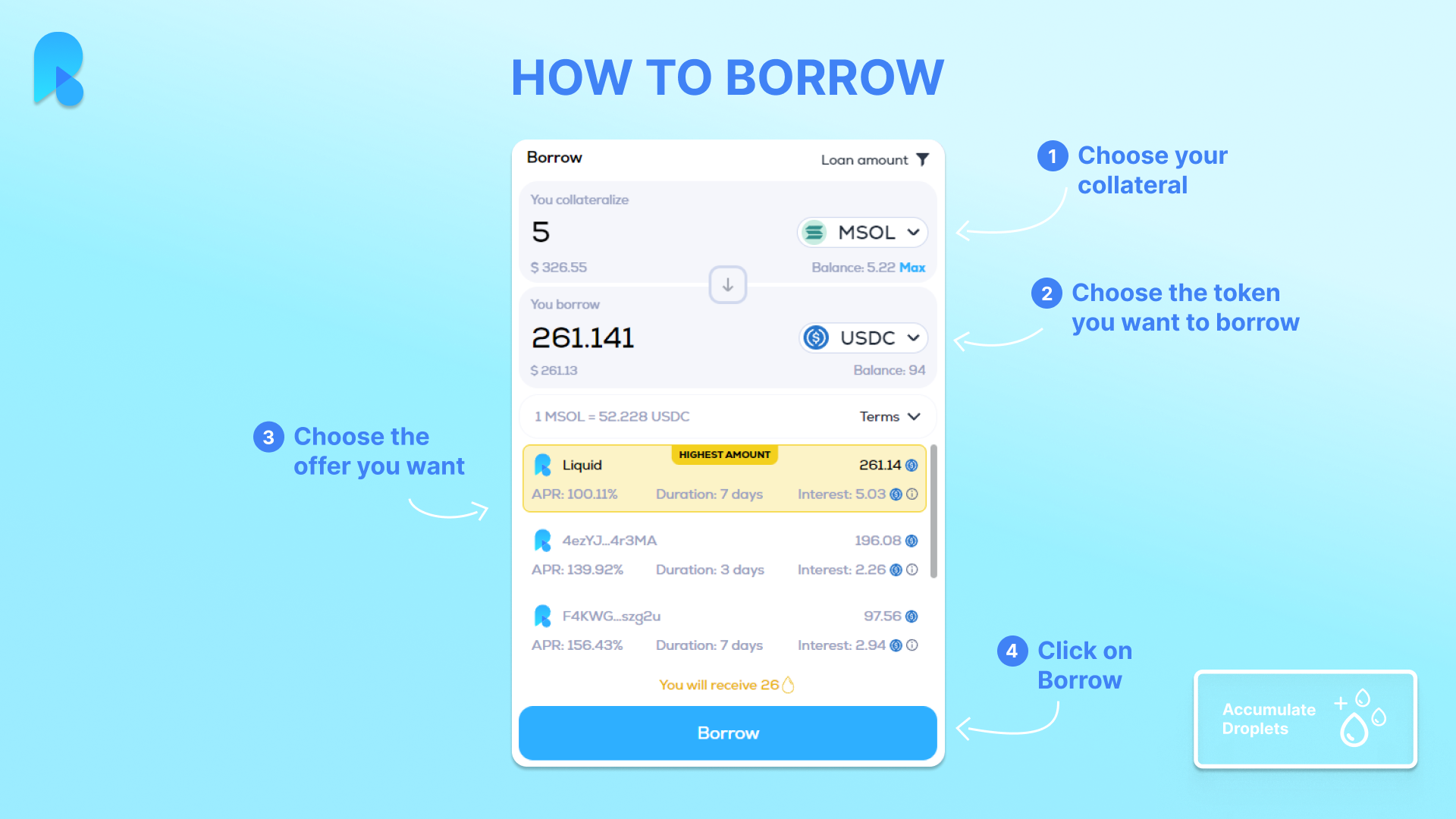

Choose your asset that you wish to deposit as Collateral:

✔️ Crypto assets (SOL, wETH, wBTC, Memecoins etc.)

✔️ NFTs

Once your collateral is deposited, select the asset you wish to borrow.

📌 Borrowed assets are sent directly to your wallet, allowing you to use them freely across the DeFi ecosystem.

Rain.fi operates with user-created liquidity pools, meaning loan conditions vary based on lenders’ preferences.

Borrowing $1,000 at a 50% APR for 5 days:

To start the loan, click on Borrow and validate the transaction in your wallet.

Once the loan is taken out and running, your Collateral (Deposit amount) is locked for the entire loan duration and you received the Loan Amount in your Wallet.

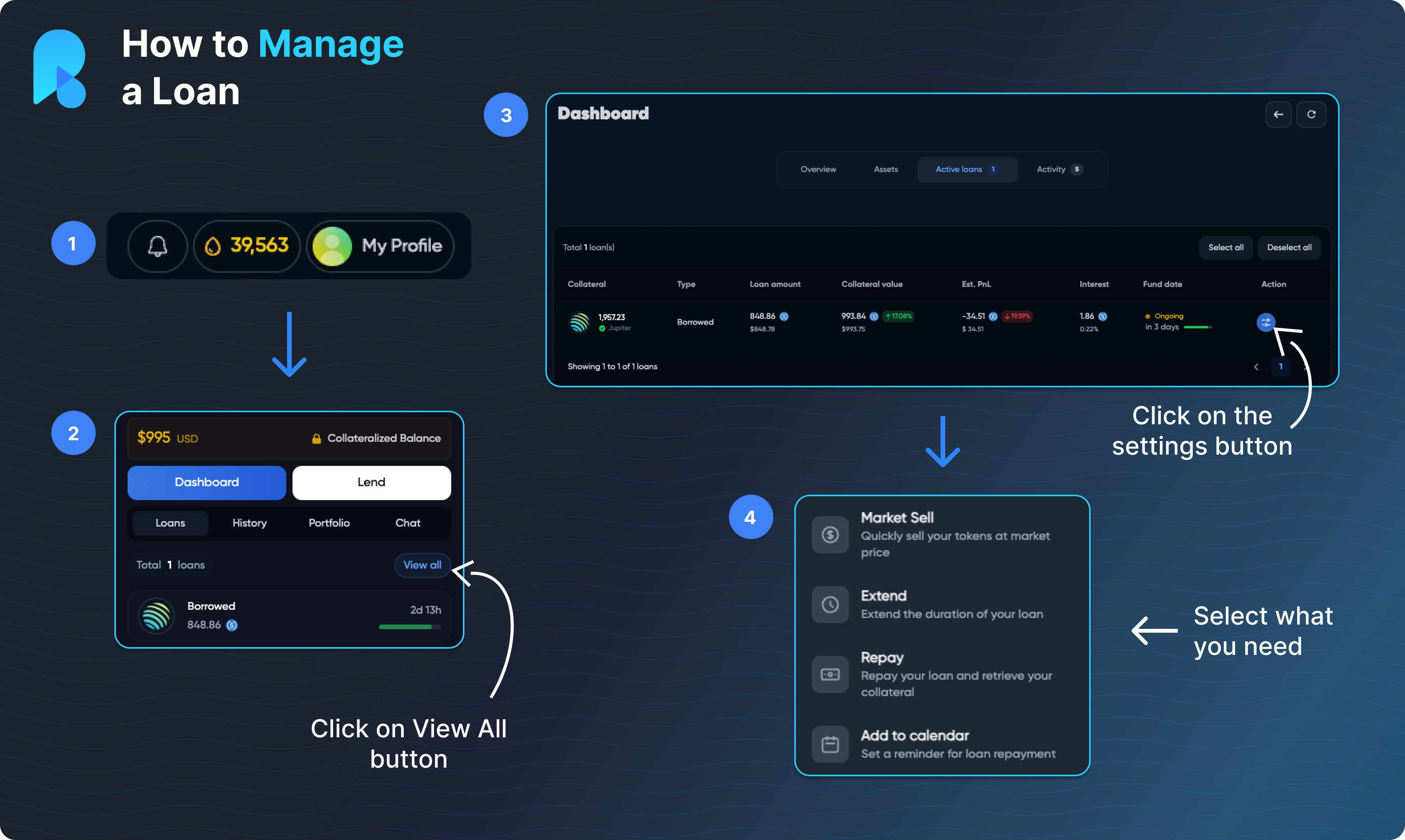

Once your Borrow loan is active, you have full control over managing your position before it expires.

Managed your loan by following these guide :

Fully repay the borrowed amount to unlock your collateral. Since the borrowed funds are in your wallet, you can use them freely, but you must ensure you have enough assets to repay before the loan expires.

📌 Repaying early can be useful if you want to retrieve your collateral sooner or if market conditions have changed.

If you need more time, you can extend the loan by selecting a new duration. If the borrowed asset has lost value, putting your loan in negative equity, you must rebalance by repaying part of the borrowed amount to restore an acceptable Loan-to-Value (LTV) ratio.

Extensions depend on available liquidity in the pool, and lenders may have adjusted their loan conditions, meaning new terms could differ from your original loan.

📌 Extending resets loan conditions based on the current market, allowing you to keep your collateral locked without needing to repay immediately.

If you no longer need the borrowed funds, you can sell the borrowed asset to repay the loan:

All loans must be repaid or extended before the expiration date.

If no action is taken before the loan expires:

📌 Borrowers should track their loan expiration dates and plan their repayment strategy accordingly.

By understanding these management options, you can make better borrowing decisions on Rain.fi and maximize the benefits of crypto-backed loans without selling your assets.

Rain.fi’s Borrow function offers a way to access liquidity without selling your assets. Whether you need stablecoins for DeFi opportunities or want to unlock the value of your NFTs, Rain.fi allows you to borrow on your terms from a pool of other users.

✅ Borrow without selling → Maintain exposure to your assets while accessing liquidity.

✅ User-controlled lending pools → Choose from multiple loan conditions that fit your needs.

✅ Unlock NFT value → Use NFTs as collateral to get instant liquidity.

✅ Full loan management control → Repay, extend, or sell your position at any time.

With customizable loan terms, no forced liquidations during the loan period, and decentralized lending, Rain.fi makes borrowing seamless and efficient for DeFi users.

📌 Check out our FAQ for answers to common borrowing questions.

🌐 Ready to try it out?

Visit Rain.fi and experience a new way to borrow.

Start borrowing from just $10… 💸

🔗 Want to use your borrowed assets for leveraged trading without price liquidations? Discover how to trade with leverage on Rain.fi here

Site: https://rain.fi/

Discord: https://discord.gg/rainfi

Twitter: https://twitter.com/RainFi_

FAQ : https://app.rain.fi/faq

RainFi Team